The Surge in Gold Prices to Unprecedented Levels

Gold is seen by central banks as a lasting store of wealth and a dependable shelter in periods of economic and worldwide upheaval.

New York CNN — Gold is being acquired by everyone ranging from central banks to patrons of Costco. The price of gold on the spot market soared to $2,364 per ounce on Tuesday, continuing a streak of reaching new highs for seven days straight, up from Monday’s trading price of $2,336 per ounce. Compared to the previous year, the value of gold has increased by 16.5%.

Investors expecting the Federal Reserve to lower its key interest rate are the main drivers pushing prices higher, while other elements like central banks, especially China, purchasing gold to lessen reliance on the US dollar, are also contributing to the price increase.

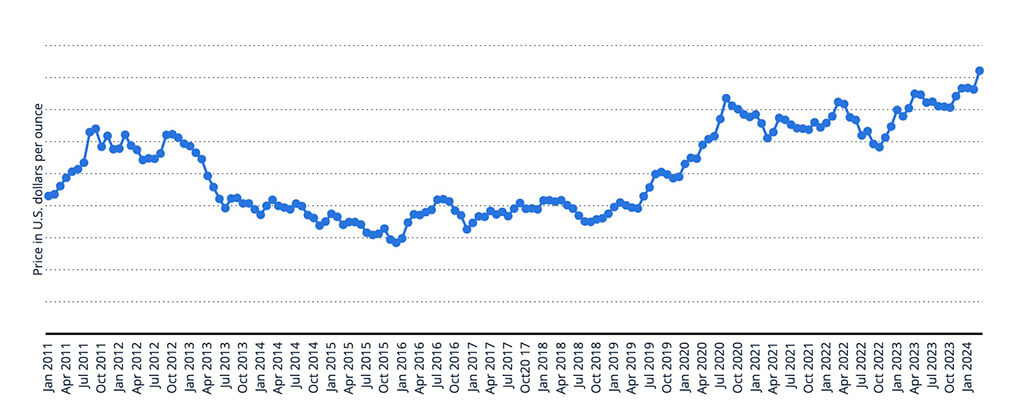

Price for an ounce of fine gold (average price) in London (morning fixing)

from January 2011 to March 2024 (in U.S. dollars)

Central Banks View Gold as a Time-Honored Asset and a Safe Haven in Times of Economic and Global Turmoil.

Gold is acknowledged as a robust investment choice. Typically, when interest rates fall, gold prices tend to rise, making bullion more appealing than assets that generate income, such as bonds. Investors also perceive gold as a hedge against inflation, expecting that it will maintain its value as prices increase.

The attractiveness of the US dollar is diminishing for central banks aiming to reduce their economic dependence on the United States, as evident in the increased interest in gold among central banks, notably spearheaded by China.

According to a JP Morgan research note from March, nations not in alignment with the US might accumulate gold to pivot away from the dollar, thereby reducing vulnerability to sanctions. The surge in gold prices since 2022 has primarily been propelled by central bank acquisitions, with gold purchases by central banks in 2022 surpassing double the average annual acquisitions from the preceding decade, as reported by JP Morgan.

The increase in prices aligns with US Treasury Secretary Janet Yellen’s visit to China to address financial stability in US-China relations, coupled with apprehensions regarding rising oil prices as a potential threat to the US economy, as stated by Mark Zandi, the chief economist at Moody’s.

Heightened oil prices are expected to trigger concerns regarding inflation, consequently propelling gold prices, as mentioned in the UBS research commentary. The prevailing viewpoint on gold suggests that the uptick in gold prices reflects investors’ expectations of potential Federal Reserve rate reductions later in the year, while grappling with uncertainties surrounding inflation control without risking a recession in the US economy, known as a soft landing.

According to a research note dated April 9, UBS considers the expectation of Federal Reserve rate cuts to be the key factor driving the optimistic outlook on gold. During his comments on April 3, Federal Reserve Chair Jerome Powell indicated that inflation is steadily moving towards the Fed’s 2% target, albeit on a somewhat challenging path, implying that rate adjustments to stabilize the economy are anticipated later in the year.

However, the job growth figures for March surpassed forecasts, casting doubt on the need for multiple rate cuts considering the current strong economy. Over the 12 months ending in February, the Personal Consumption Expenditures price index, preferred by the Federal Reserve as a measure of inflation, increased by 2.5%, slightly higher than the 2.4% growth observed in January, based on recent data from the Department of Commerce.

The core Personal Consumption Expenditures (PCE) price index, which excludes the volatile food and energy sectors, increased by 0.3% on a monthly basis. This index, considered a vital measure of underlying inflation by Federal Reserve officials, decreased from January’s 0.4% growth rate, which was the fastest in a year.

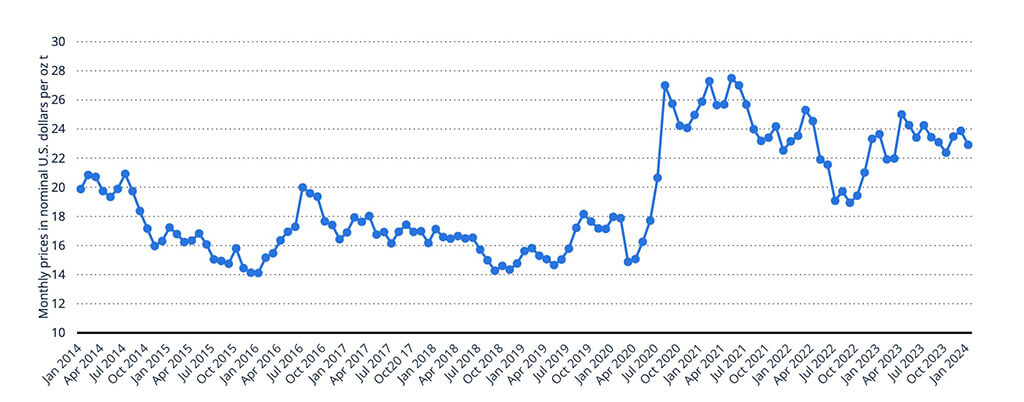

Monthly prices for silver worldwide from January 2014 to January 2024 (in

nominal U.S. dollars per troy ounce)

What’s driving the current surge in gold prices?

Some investors are jumping on the bandwagon of gold bullion’s increasing popularity, fueling the upward momentum. Enthusiastic gold buyers on Reddit often discuss their purchases. Costco introduced online sales of gold bars in August and silver coins in January, potentially generating sales of over $200 million in gold and silver each month, as estimated by Wells Fargo. Chief Financial Officer Richard Galanti disclosed to analysts last December that the company had sold more than $100 million worth of gold bars in the preceding quarter.

As stated in the investment note dated April 9, the higher number of Reddit posts, rapid online product sell-outs, and robust monthly e-commerce sales indicate a noticeable uptick in momentum following the launch. Lindahl emphasized that both “trend followers” and other participants are engaging in the price surge, foreseeing substantially higher prices in the future.

Gold stands out as a traditional asset in times of political uncertainty. With elections slated in more than 60 nations this year, including the US presidential race, the increase in geopolitical and economic unpredictability highlights the persistent value of this precious metal.

This structure represents the main sections and subtopics covered in the provided text regarding the jewelry industry in the UK.

Please contact us for the full version of this report in PDF file.